Investing made simple | Partner Content

If we had a penny for every investment we’d ever made…

…well, it’d be clear that we have no idea what we’re doing.

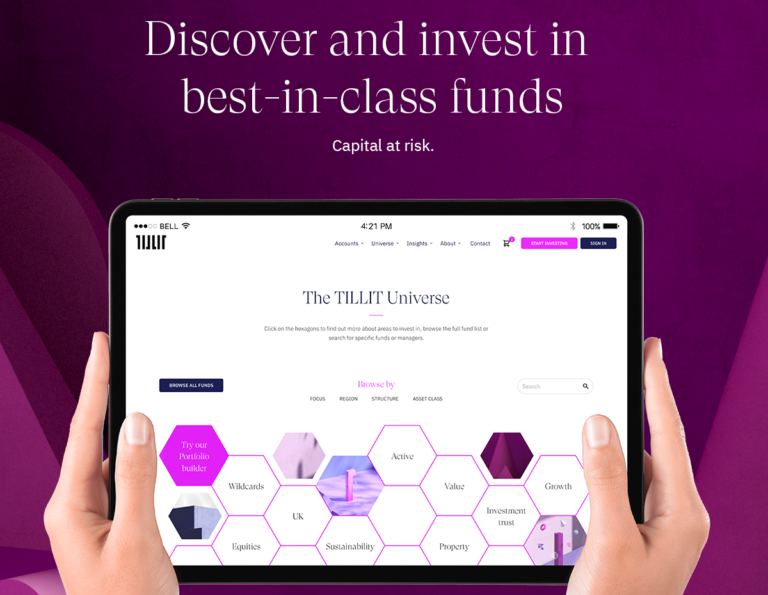

The people at TILLIT, however, are experts on the subject – in fact, they have over 100 years’ fund management experience between them. And they’re putting it all to good use, by creating a hand-picked, curated platform featuring the best funds to back, with a view to making investing more accessible to everyone… and you can get started with just £1.

How does it work? Well, their team of fiscally-savvy elves work tirelessly behind the scenes, trawling through the 5,500 funds that are open to private investors in the UK and picking out only the best in class. They then present their findings in snappy summaries on the TILLIT app, where you can browse through their recommendations and choose the funds you want to back, safe in the knowledge that someone really clued-up has already given it their blessing. You’ve been burned before by backing your uncle’s jetpack business; that’s not going to happen here.

TILLIT only features funds, believing (in their considered opinion) that they represent the best bet for private investors – so no volatile trading, no dodgy crypto. And every fund that’s featured on the TILLIT platform has been independently selected on its own merit – there have been no backhanders or incentives offered in exchange for promotion.

Finally, they don’t charge you anything to trade, transfer or exit (withdraw your investment) – instead, they charge a nominal percentage on what’s on your TILLIT account, starting at 0.4% in the first year and actually getting smaller from there. Plus, it’s all FCA approved and FSCS protected (which is shorthand for: it’s all legit).

Obviously, nobody can promise to make you a millionaire – not even Chris Tarrant.

But TILLIT doesn’t seem like a terrible place to make a start…

NOTE: You can find out more about TILLIT, and start investing from as little as £1, HERE. Capital at risk.